Case Study

Lending Analytics Solution for a Leading African Bank

Client: A leading African bank

Our Expertise: Business Intelligence

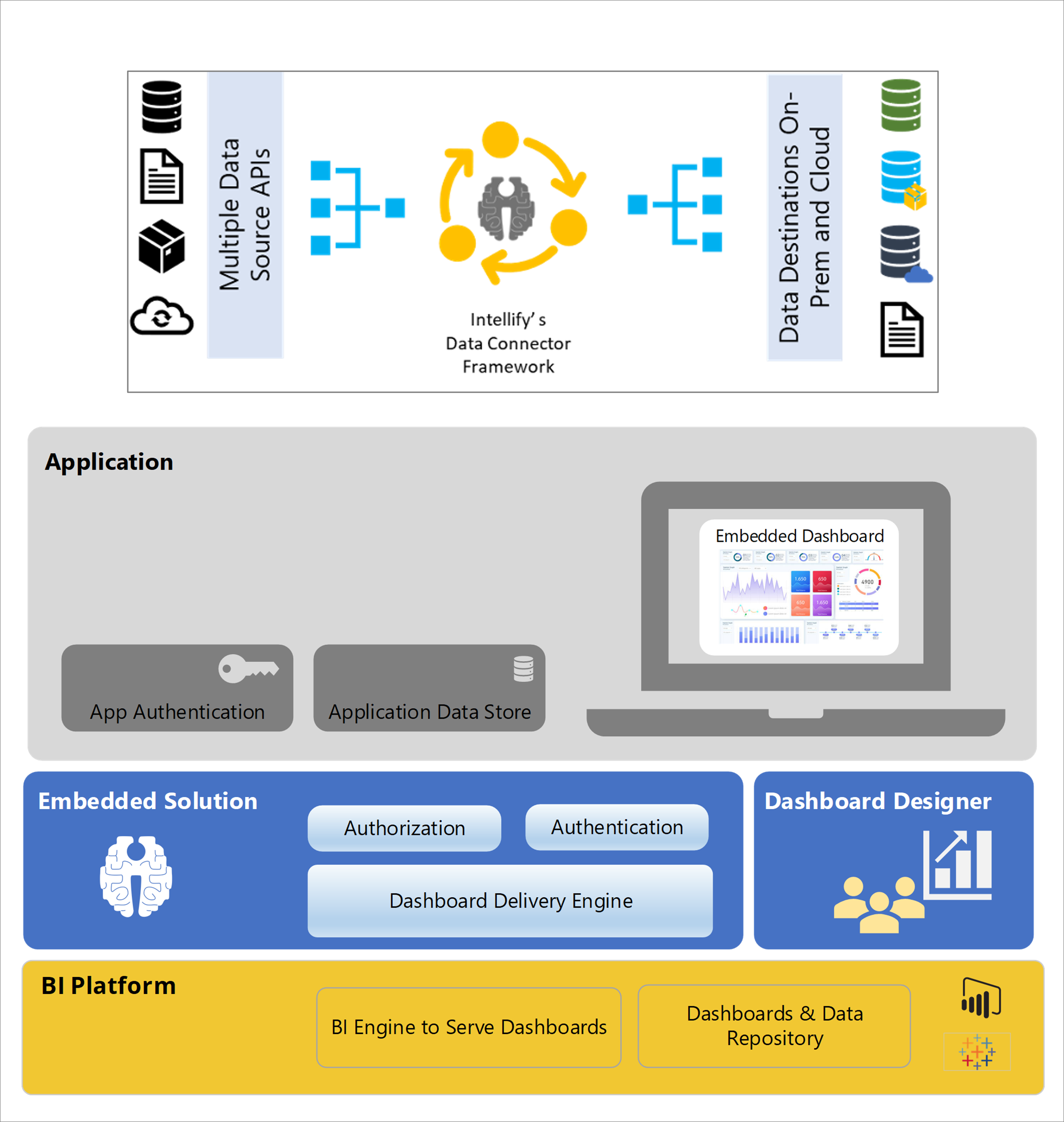

Technology Used: Microsoft Power BI, Power BI Embedded, Angular JS, Intellify Data Connector Framework, Intellify Embedded Analytics Engine, Azure SQL, Microsoft Azure

PROBLEM STATEMENT

A leading African Bank has Loan Management Suite (Loan Origination, Loan Management and Collection systems) for different loan products.

System had data analysis and reporting but the data underlying that was not always of good quality and was not structured in ways that easily fulfilled the reporting needs. Management had to rely on team leaders for reporting or sometimes need to scroll through different systems to get insights.

Bank was looking for cost effective centralised reporting system which can also focus on compliance reporting, decision ready dashboards and Operational dashboards for different types of 60+ stakeholders.

SOLUTION

Intellify recommended ‘Intellify’s Embedded Analytics’ solution as a cost effective and user-friendly solution for the bank.

- With our proprietary Data Connectors framework, we extracted the data from LOS, LMS and Collections systems and deployed it into the central data model created on the Cloud using Azure Datawarehouse.

- Our team along with SME’s developed 16 persona specific decision friendly dashboards for 3 business processes.

- Together, these dashboards were tracking 100+ KPIs and 1000+ data points to serve the decision making, compliance management and operational usage purpose.

- The SaaS platform with Intellify’s Dashboard Delivery Engine sliced and diced the data based on the roles and responsibilities of users.

- Intellify’s Embedded component was very user friendly to integrate in operations system with couple of lines of code.

BENEFITS

Rapid Data Discovery

Higher level of visibility

Informed Decision Making

Empowered Users

Read More Success Stories

AI based safety compliance management for a leading manufacturing company

Built conversational BOT for US based Digital Bank