Lending Analytics Solution

Intellify’s ready-to-use solutions for Data-Driven-Decisions

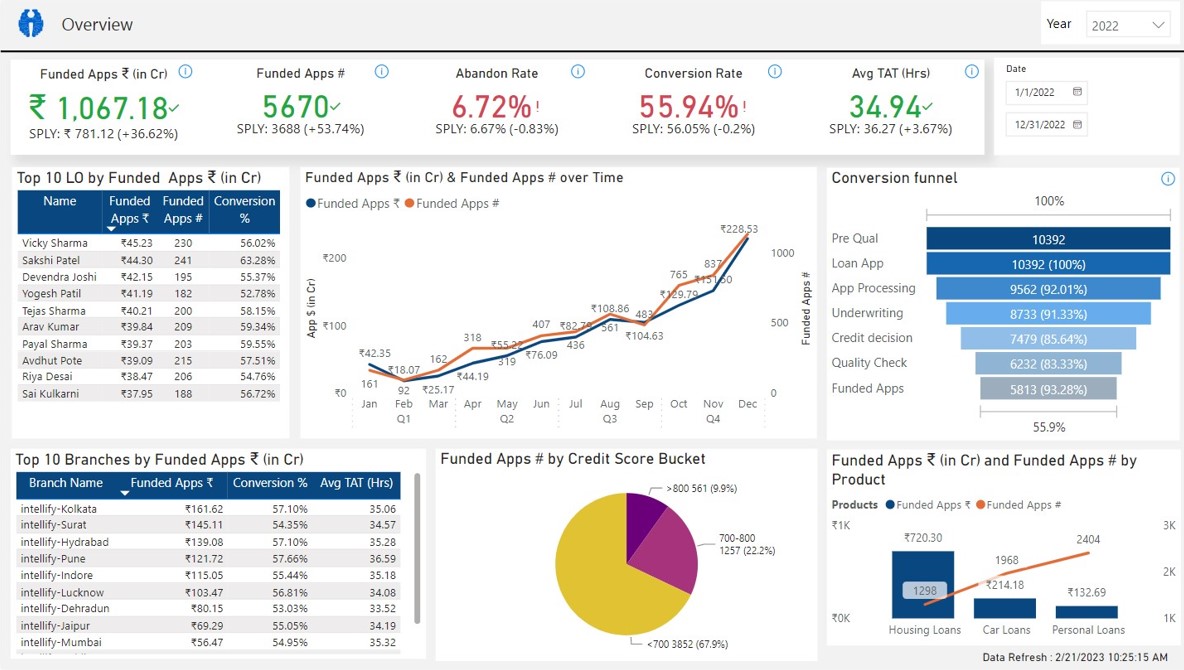

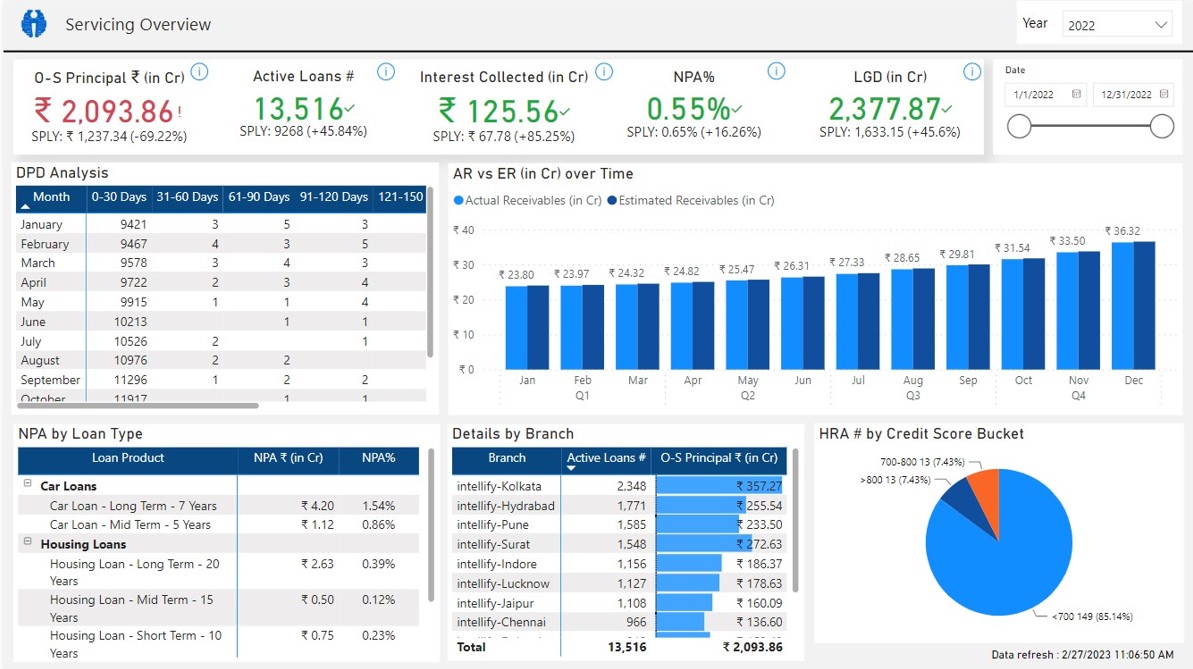

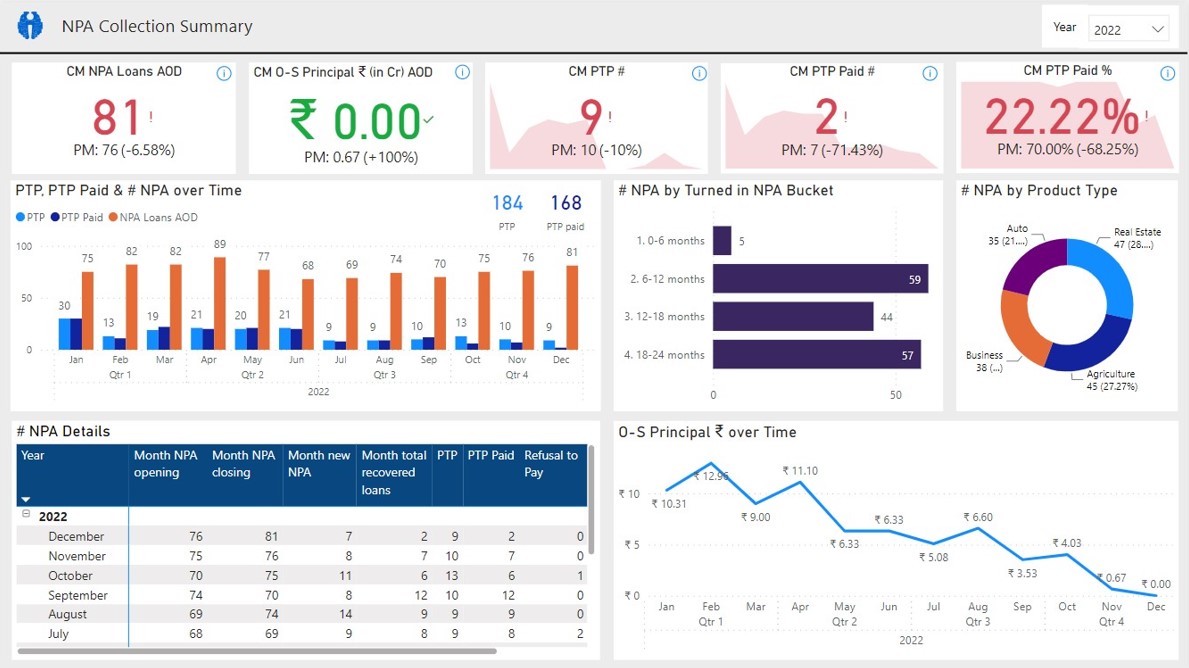

Intellify’s Lending Analytics Solution (LOS, LMS, Delinquency)

Maximise Performance. Minimize Risk. Improve Operational Efficiencies

Intellify’s Lending Analytics solution drives Business Decisions based on the data. It helps you get answers for business-critical questions like:

- Who is contributing to your leakages of sales funnel, and do you know why?

- Do you know which customer segments to target? As customer acquisition costs are skyrocketing and you want to want to have tighter control over it.

- Who wants more loans from your existing pool of customers?

- What are the operational gaps and areas of improvements?

- What is NPA percentage and how is it trending? Any co-relation between NPA and regions/branches/Loan issuing authorities?

- Do you know which of your collection agent and strategy works best in collections?

and unravel many more such insights

Solution Highlights:

3 core business processes

Cross functional dashboards

100+ Industry standard KPIs

1000+ Data points captured

Single source of truth

Insights at point of use

Lending Analytics Overview