Benefits of Having Inetllify’s Lending Analytics Solution for Your Lending Institution

Geopolitical situations, inflation, oil prices, and fluctuations in the interest rates are some of the common reasons why economic situations are volatile and dynamic in nature. Apart from this, the domestic financial policy of each country also plays an important role in the dynamics of the economic situation. Lending institutions always need to keep an eye out for all such scenarios and keep themselves updated on the regulations.

Mahesh Balshetwar, Co-founder of Intellify Solutions, shared his thoughts on Lending scenario during Global Turmoil. He highlighted some interesting facts about the ongoing lending and debt situations and different ways to create a positive impact in such challenging situations.

It pushes Lending Institutions to think through on certain performance indicators which will help them get competitive advantage over peers.

- Is Lending Institution targeting right set of customers?

- Are regulatory indicators getting monitored constantly to avoid financial penalties and restrictions from the authorities?

- Does Lending Institutions have a system in place where they can get early warning signs of default on payments?

- Is your current data give insights to design loan products for future?

What are the conversion ratios and Customer Satisfaction scores to measure operational efficiencies? And so on…

Having these answers on fingertips will put lending institutions in a commanding position to tackle their portfolio better.. And the answers lie in their own business data! It just needs to be used at its complete potential!

Intellify’s Lending Analytics Solution

To stay ahead in the competition, it becomes extremely important and critical for Lending Houses to have modern Business Intelligence system in place.

Intellify’s Business Intelligence and Analytics Solutions built by industry experts helps Lending Institutions make well informed business decisions based on the data.

Here are some key features of Intellify’s Lending Analytics solution:

- Covers all three processes of lending business: Loan Origination, Loan Servicing and Delinquency Management.

- Provides more than 18 interactive dashboards

- Capturing 1000+ data points to analyse and segment data.

- Track and monitor more than 100 KPIs for business processes.

- Quick integration with existing application makes Insights available at point of use

With the above-mentioned features, Intellify’s Lending Analytics solution creates a single source of truth and consolidates data from various sources into one solution. The decision-making process becomes much faster as there is single point of reference.

Watck our Lending Analytics Solution Overview

Lending Business Processes Covered by Intellify’s Solutions:

Let’s take a look at some of the metrics that are tracked by the Intellify Lending Analytics solution at each stage:

1. Loan Origination:

This is the first process for the lending business. Customers’ loan applications are profiled and made sure that whether they are eligible or not for the loan by the lending business. Intellify’s Lending Analytics solution tracks various data points such as average acquisition cost, credit score analysis conversion ratio, product penetration rates, channel performance, turnaround efficiencies, application volume and so on.

2. Loan Servicing:

After customer profiling and application, if the customer is eligible, funding is done and servicing phase starts. At this stage, metrics such as foreclosure rates, credit risk, portfolio quality, Days Past Due (DPD), overdue ageing, Business unit IRR , probability of default and so on are analysed. Lending businesses have an opportunity to identify cross-selling and up-selling opportunities with these metrics.

Read our blog about How Does Business Intelligence Help in Loan Servicing?

3. Delinquency:

Intellify’s Lending Analytics solution can track metrics such as delinquency roll rates, NPA analysis, and DPD analysis, collection strategy analysis. Intellify’s BI solution also helps you provide data through which you will receive fraud detection alerts.

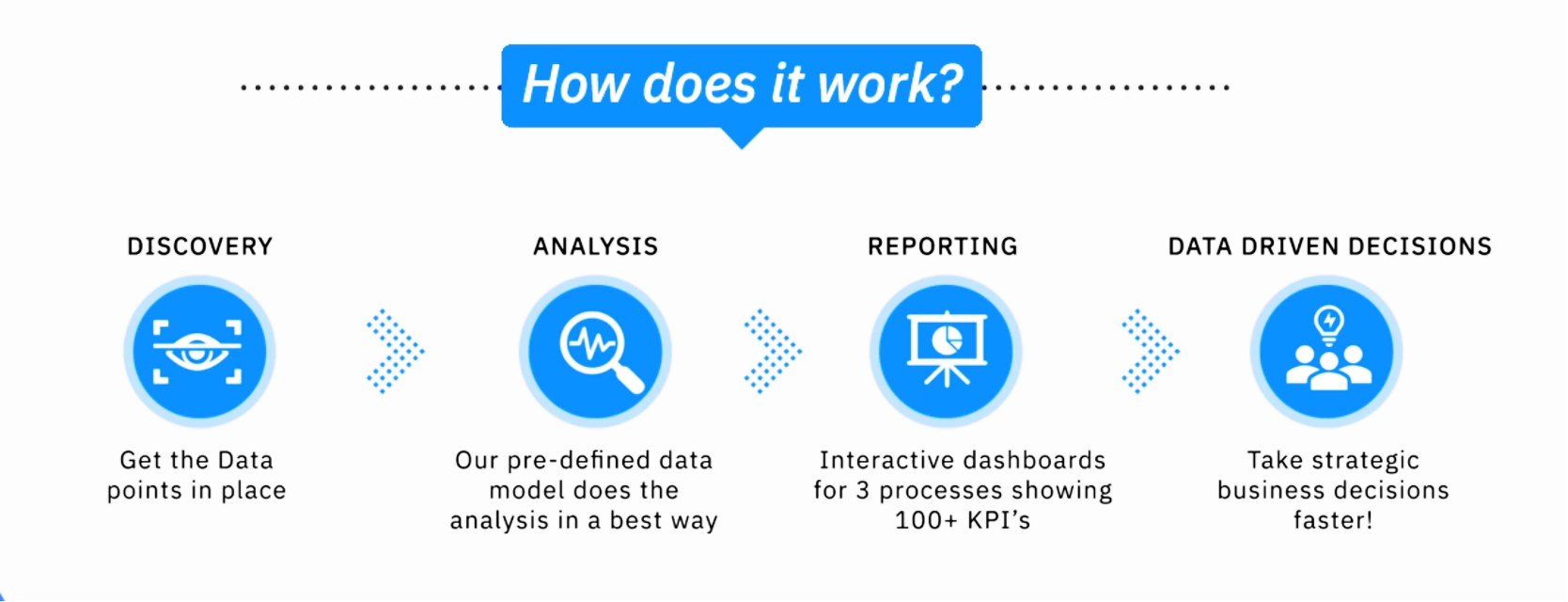

How Does Intellify’s Lending Analytics Solution Work?

Benefits of Having Intellify’s Analytics Solution

1. Get Decisive Insights:

Intellify’s Lending Analytics solution is built by Industry and technology experts. Our deep dived solution provide insights which helps make data driven decision making.

2. Achieve Business Growth & Operational Efficiency:

Intellify’s lending analytics solutions help your lending business to understand your customer profiles using various parameters like Age, gender, income level, region etc. By doing this, you can identify cross-selling and up-selling opportunities from your existing customers and scale up your business with less customer acquisition cost. Operational efficiency for your business is also achieved by tracking operational performance indicators on time and taking appropriate actions.

3. Early Warning Signs of Credit & Risks:

Credit and risks management are the most important challenges faced by lending businesses. Intellify’s Lending Analytics solution gives you early warnings and signals about potential fraud by analysing your business data and revealing the patterns. It helps you to deep dive into the issues and rectify them on time before it’s too late.

4. Reduce Delinquencies & Maximize Collections:

Intellify’s Lending Analytics solution helps you understand customer behaviour and characteristics to maximize collection yields. With our solution, lending institutions gets a nuanced understanding of the customer behaviour, customer demographics, account activities, collection and risk ratings, credit history which helps in further classification of customers into the micro-segments to monitor delinquencies and implement different collection strategies.

It helps in identifying most suitable collection strategies for different micro-segments.

5. Quick Integration with Existing Application:

Intellify’s Embedded Analytics Solution will help you embed Intellify’s Lending Analytics solution into the web application or a product quickly and seamlessly.

Embedded solution highlights:

- Complete white labelled solution

- Easy and quick to implement

- Row Level Security and dashboard level security

- Dedicated admin portal and much more.

To know more about Intellify’s Embedded Analytics Solution, click here.