Five C’s of Credit: What Are They & How They Help Lending Institutions in Decision-Making?

Lending institutions are inherently high-risk businesses. Non-payment of the loan amount, credit fraud, shortage of liquid funds, etc. are some of the many risks lending institutions carry with them. These risks can lead to major disasters, even leading to bankruptcies and shutting down of institutions.

To avoid such disasters, many risk management techniques are used by lending institutions. One such method is known as the Five C’s of Credit.

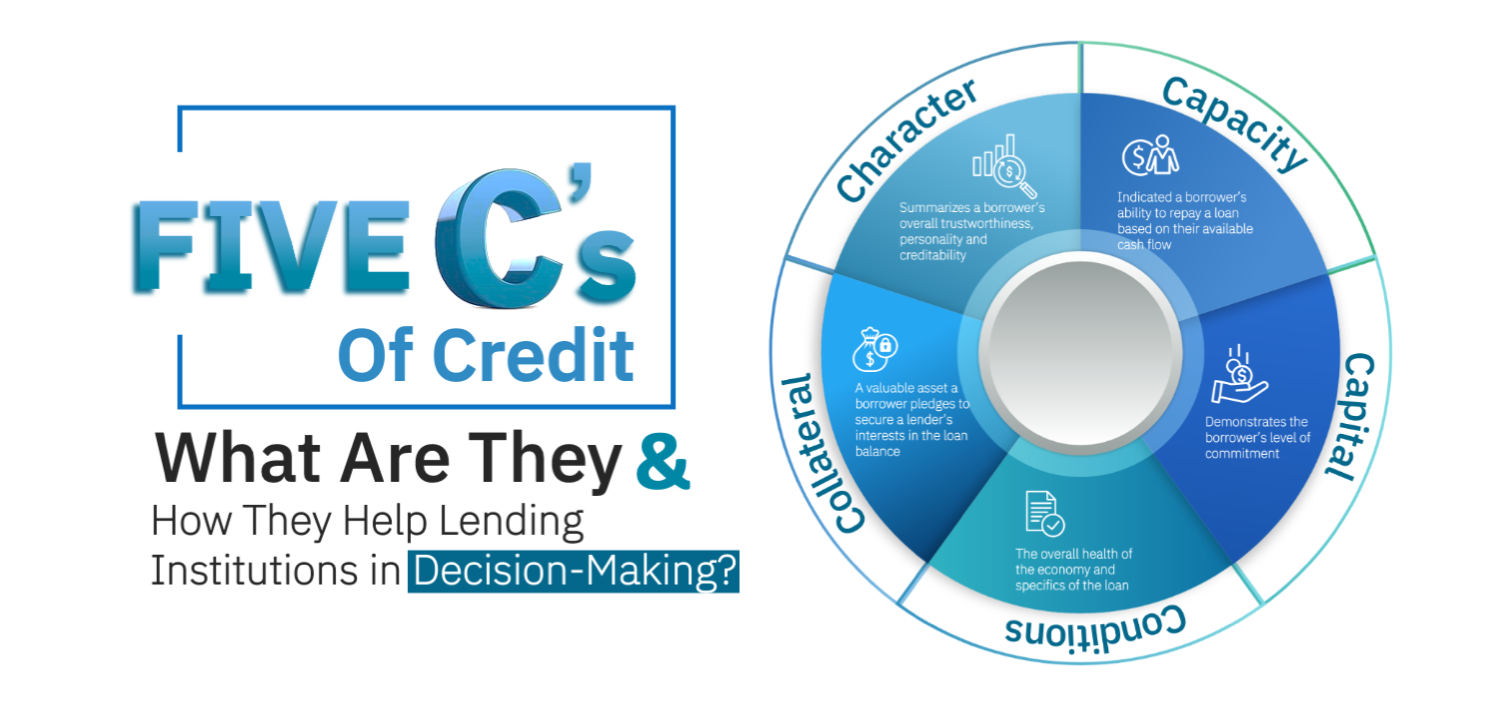

Understanding Five C’s of Credit

The five C’s of lending or credit is a method used by these institutions to learn, understand and evaluate the reliability of potential and existing borrowers repaying the principal amount.

The five parameters help lending institutions recognize the trustworthiness the borrower carries. This is a method for institutions to understand the chances of default on a payment or delinquencies and as a result lending institutions may have to face financial risk in case of non-performing assets.

Each lending institutions have its methodologies to assess and evaluate a borrower’s trustworthiness. However, these five C’s are commonly used for assessing the financial risk the lenders may carry. By checking bank statements, credit scores and other relevant documents, lending institutions can assess the previous credit history of the borrower.

What are the Five C’s of Credit?

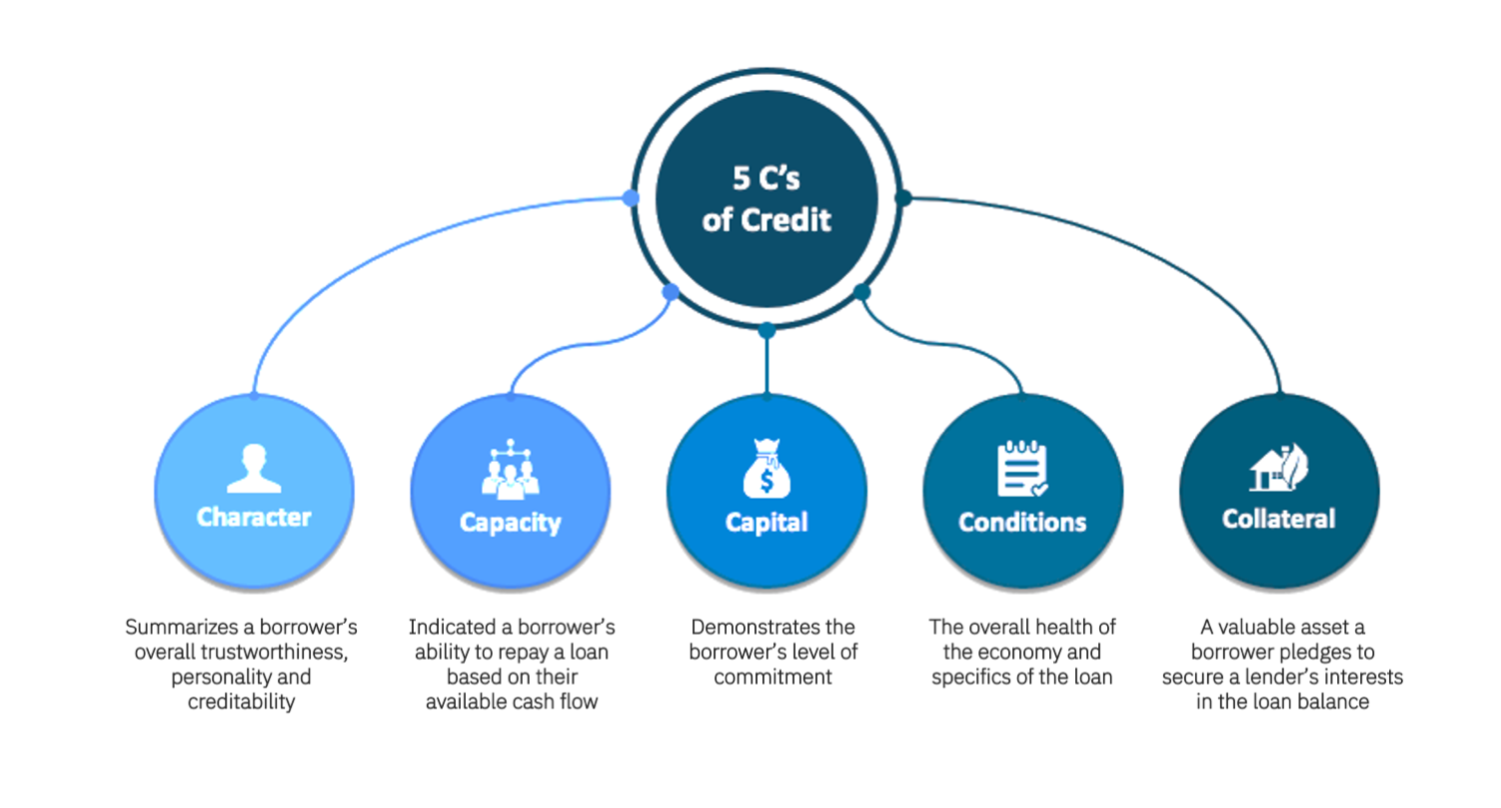

1. Character

Character refers to the credit history of the borrower. It talks about the likelihood of the borrower paying back the loan amount. Based on various factors, the credit bureau calculates the credit score of the borrower. This credit score determines the creditworthiness and reliability of the borrower paying back the loan amount on time.

Two key factors that determine the credit score are:

- Number of loans taken previously and their repayment history

- Number of credit cards used and their repayment history.

CBIL, CRIF, Experian and Equifax are such organizations which have developed methodologies to score Individuals and organizations based on their financial behaviour. The higher the credit score, the more trustworthy and reliable the borrower is about making their payments on time.

2. Capacity

Capacity defines the ability of the borrower to repay the loan amount. Here, the financial liquidity of the borrower is assessed. By determining the monthly income and expenditure of the borrower, the capacity of a borrower is evaluated along with the number of debts paid every month. The purpose to evaluate capacity is to understand whether the borrower can repay the loan amount or not.

For organizations, previous financial statements such as profit or loss statements, cash flow statements and so on are analysed. This analysis helps lenders determine whether the organization is making enough revenue and do they have cash reserves or not in case of a business downturn.

For individuals, detailed information about their income needs to be provided. Debit and credit card statements, salary slips and so on are some of the many documents that are analysed and evaluated by lenders to understand the liquidity of an individual borrower.

Mortgage companies or banks use Debt-to-Income/Debt Burden Ratio. This ratio states a borrower’s monthly debt as a percentage of his monthly income. Higher ratio means higher risk for lenders which may result in rejection of the loan or alternations to terms of the repayment.

Debt to Income Ratio/Debt Burden Ratio= Recurring Monthly Debt/ Gross Monthly Income.

3. Capital

Capital assessment, when it comes to extending the credit to a borrower, basically means how much money is the borrower putting forward towards the investment for which the loan is being issued. This shows the seriousness of the borrower towards the investment being made.

Say a business wants to raise a loan of $ 500,000 for the advance purchase of goods. The business owner invests a sum of $ 100,000 from his capital and borrows the remaining $ 400,000 from a bank. This showcases that the business owner is risking his capital of $ 100,000 along with the bank loan of $ 400,000. Trustworthiness in such instances between the borrower and lender increases as capital risks are partially shared by both parties.

By investing their capital, the borrower can also get better repayment terms and chances of lower interest rates as lenders do not carry 100% risk in such cases.

Lending Institutes use Loan-to-Value (LTV) ratio to determine how much risk they’re taking on lending. It measures the loan amount and market value of the asset

Loan-to-Value (LTV) = (Amount owed on the loan ÷ Appraised value of asset) × 100

4. Collateral

Collateral are the assets that a borrower provides as a security to the lender in case they are unable to pay the loan. The lender has the right to seize the asset and release it only when the loan amount is paid. If the borrower fails to pay the loan amount, the lender can recover the due loan amount from the asset by auctioning the same.

This is a risk management method that safeguards the interest of the lender. The lending institution has assessed, analysed and evaluated the credit worthiness of the borrower on various parameters and only then loans are issued to them. However, certain unforeseen circumstances can arise wherein the borrower is unable to pay back the amount. For the lender, it becomes a massive financial burden and can cause cash flow-related issues. Collateral allows lending institutions to secure themselves from such risks.

5. Conditions

Conditions refer to the terms of the loan itself, as well as any economic conditions that might affect the borrower. In addition to evaluating borrower’s personal finances, lenders look at other financial conditions like the overall health of the economy and terms of the loan.

There can be a scenario where the overall economic trend may have a bearish outlook but the industry in which the borrower works or has their business is booming. In such cases, evaluation becomes more subjective, and it will depend on mutual agreement between borrower and lending institutions in regard to loan payment terms.

Credit Risk Analysis & Business Intelligence

Through the five C’s, a thorough risk analysis is made of the borrowers. This risk assessment helps lending institutions not only to safeguard their current financial situation but also learn about different behaviour patterns of the borrowers. This helps lending institutions to target right borrowers or prospects to improve and grow their business.

Here is where the role of business intelligence (BI) and data analytics becomes very crucial. Lending institutions may have done a thorough risk assessment of their borrowers and also may have identified patterns, but dashboards help to create a visual story out of it. This helps the top management to make critical decisions easily and can also identify opportunities to grow their business.

With the help of Business Intelligence and Data Analytics along with right KPIs, lending institutions can have the data-driven insights in time. Therefore, the growth of the business can be monitored in real-time and interactively through Lending Analytics Solutions.

Read our blog about Optimize Credit Risk Management by Leveraging Lending Analytics Solution

The Intellify Advantage

Intellify has years of expertise in creating aesthetic and visually appealing dashboards for lending institutions. We offer ready-to-go lending analytics solution that can be deployed at your organization in 4 weeks time. With more than 18 dashboards for Loan Origination, Loan Servicing & Loan Collections and covering 100+ KPIs using 1000+ data points. Intellify’s Lending Analytics Solution is the answer you are looking for growing your Lending Business.

Click here to get in touch with our experts to learn more about our solutions.