Can Data Analytics Reduce NPAs?

Post the first phase of Economic Liberalization in 1991; the banking industry has seen massive transformations of all time. However, as per the Narasimha Committee recommendation and the government’s approval, asset quality never seems to be the prime concern in this sector. But the recent mounting of non-performing assets (NPAs) has become one of the prominent concerns for the banking industry.

No wonder experts are relying on data analytics for NPA management. After the lockdown due to the COVID pandemic, this has been a priority for the bank and financial institutions to use data analytics to deal with the significant concerns of NPA management. However, before diving into the details of this concept, let’s look at what NPA is and how data analytics can seamlessly handle the entire management.

What is NPA?

A Non-Performing Asset or NPA refers to the classification often used by different financial centres for any advances or loans in arrears or default. That means the principal amount is still due, and no interest payments have been made in the last 90 days or beyond.

Categories Of NPA:

The different types of NPA are:

- Standard Assets are the ones for which the borrower is regularly paying both the principal amount as well as interest

- Substandard Assets refers to the ones who remain overdue for 12 months or lesser than that period

- A Doubtful Assets refers to one with all the characteristics of the sub-standard assets while non-performing for more than 12 months

- A Loss Assets are one which are often considered to be uncollectible and is preferred to be entirely written off by the Auditor or Bank

Preventive Measures:

Some of the preventive measures for NPA management are:

- Focus on accumulating the borrower CIBIL score (India) before lending

- Utilize different settlement options

- Large NPAs need proper management strategy and strict action against the borrower

- Faster settlement of dues requires alternative dispute measures like Lok Adalats and Debt Recovery Tribunals

- Use Asset Reconstruction Company

- Be active in circulating the defaulter’s list and information to prevent such occurring

- Corporate Debt Restructuring did restore the company’s liquidity to avoid bankruptcy

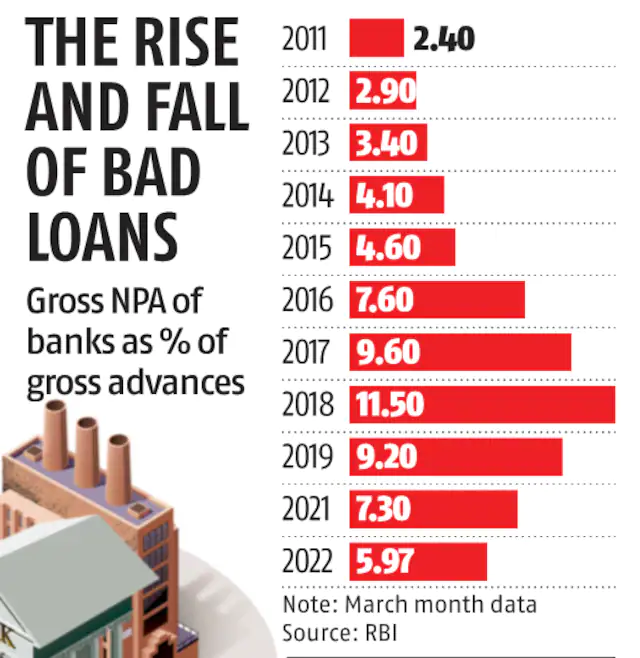

Current NPA Scenario

The gross NPAs of the banking industry have dropped much lower than 6% as per the reports of March 2022. It is the lowest since 2016, and the net NPAs have dropped to 1.7% during this same tenure.

Source: business-standard.com

Factors Contributing to NPA’s

Poor Credit Discipline and Inadequate Credit & Risk Management process:

Poor credit discipline is one of the potential reasons behind the NPAs. Banks need to manage such credit risks by considering both entire portfolios along with the risks involved with the transactions and individual credits. To avoid such NPA surge, it is essential to focus on Credit Risk Management process.

Proper Sourcing of Loan Application:

Failure to formulate the proper sourcing of the loan applications can also be the driving factor for the NPAs. Therefore, before granting the advances to any individual, the lending institution needs to be cautious about the proper sourcing of the borrower documents and loan application to avoid payment defaults.

Wilful Defaults:

Some cases mark the wilful defaulters from the borrower’s end. Despite having a decent income and good cash flow, these borrowers choose to deliberately not to make the payments on time.

Change in Govt. policies:

Sudden changes in government policies can also lead to the accumulation of defaulters and thereby continue to increase the pending NPAs in the banking sectors.

Other factors that contribute to the NPAs include:

- Inaccuracy in defining the proper process flows within any lending centres

- Lenient credit terms often lead to loan approval for borrowers without any credit check

- Collateral-free loans often lead to payment defaults as these do not offer any security against the loan amount

- Loose credit monitoring and improper due diligence are also the contributing factors

Different Ways to Recover NPA’s

Some of the proven ways to recover the NPAs are:

- Recovery through Lok Adalat, SARFAESI proceedings, DRT, filing Civil suit and more. Lok Adalat is nothing but a people’s court which is considered to be the easiest and fastest method of loan recovery.

- Debts Recovery Tribunals (DRT) is established under the RDB Act (Recovery of Debts and Bankruptcy Act), 1993. It effectively provides expeditious adjudication and debt recovery to financial institutions.

- SARFAESI Proceedings or Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act can regulate securitization and financial asset reconstruction while enforcing security interests and offering the central database created based on property rights. In addition, it is helpful in the efficient recovery of NPAs.

- Filing a civil suit for recovery of dues happens to be a rapid and proven remedy for recovering the loan amount from the delinquent.

- Introduction of Bankruptcy code 2016 is the Indian law which creates an overall consolidated framework that works with the bankruptcy proceedings for the partnership firms, companies and even for individual users.

- Credit Risk Management, another way to recover the money, involves determining the overall creditworthiness of the borrower, the project’s credit appraisal, and more factors. Effective Management Information System or MIS can monitor the early alarming signs of the project while detecting potential issues and alerting the management to take quick actions.

- Days Past Due analysis can help the organizations to understand the risk-prone user groups which shall never be approached for starting new businesses. Furthermore, it helps in user portfolio and data accumulation which can facilitate customer segregation based on banking interactions and behaviour.

Role Of Analytics in NPA Management

Digitalization is being implemented in every possible way in each sector. So, why not utilize it for the Lending sector as well? Data Analytics and the latest AI/ML technologies seems to be helping multiple financial industry requirements to manage the retail landscape without hassle. Here are some of the ways data analytics play a significant role in NPA management:

- Identifying customer profile, their finance discipline, and their repayment patterns

- Determine the pattern of defaulters and their potential reasons for missing out on payment due dates

- Risk identification and quantification are done based on the occurrences as well as determining the scale of impact

- Risk classification is done based on the low and high probabilities

- Credit profile evaluations along with credit rating

- Detection of forgery by analysing the loan applications and other documents

- Validation checks and loan document accuracy

- Appropriate market asset valuation is done to avoid any future defaults

- Data-driven collection process and personalized strategy devised

How does Intellify’s Solution help?

So, who can be your ultimate partner to keep a close eye on your Lending business and have tighter control over managing the NPAs? Intellify is the perfect solution in this regard for the following reasons:

Understanding Customer Personas:

Before approving any loan to your customer, one of the primary things to do is to understand their preferences and banking habits. Intellify is known for using advanced technology and data analytics to understand and analyse the customer profile along with their regular practices and previous borrowing history to lower the chances of NPAs.

Detecting Early warning Signs NPA Accounts:

One of the reasons why NPAs keep accumulating is due to failure to detect the early signs. With the latest data analytics solutions, one can now identify the possible risks in lending in advance and forecast default. So, overall, it helps in maintaining the institution’s asset quality.

Total Outstanding Principal at Risk:

Intellify helps you understand the total outstanding principal at significant risk.

Click here to get in touch with us for more details and schedule a live demo of Intellify’s Lending Analytics Solution.